New taxes on oil, gas could cause economic pain in Alaska, across America” Guest Commentary. Aug 16, 2023

EDITORIAL: The reversal of Jay Hammond’s Permanent Fund dream, ADN, May 20, 2023

While the end of the legislative session gives some hope that legislators can exercise restraint and not go overboard in either direction involving the balance between large dividend demands and funding essential services, the debate continues to lose sight of former Gov. Jay Hammond’s vision for the financial security of Alaskans. Moreover, a resource intended to inspire Alaskans to keep a close eye on how state government managed its resources, the dividend has become the only function of government that motivates a fair swath of residents.

In the fight between the constituent-supported Mega-PFD and fully funded government services, using savings from booming years is only a short-term solution.

“One can easily see how once savings are gone, the only alternative for funding government would be to dip into the Permanent Fund itself. In short, the annual dividend has become the single most dangerous threat to the Permanent Fund itself, which it was designed to protect.”

Opinion: Sales tax proposal defies logic, Juneau Empire, May 11, 2023

Opinion: Sales tax proposal defies logic

Nor does it even make horse sense. By Frank Murkowski

Opinion: Transformational policies for economic growth, Rep. Zac Fields

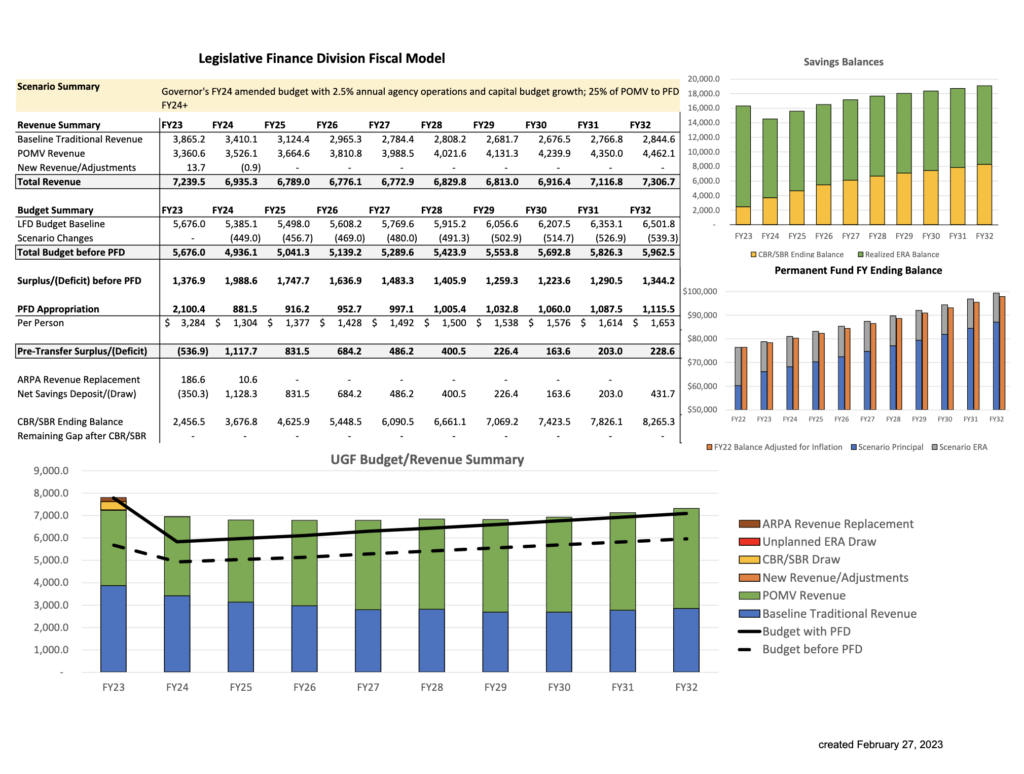

Leg Finance shares fiscal outlook with second Senate Committee substitutes for Operating and Capital Budgets, including 25% POMV (est. $1,304 PP)

Rep Ortiz says state can’t afford 50-50 dividend

House Finance Committee presentation. March 30, 2023

See the hearing here at 2 hours 30 mins

Hannan Amendment fails to pass in House Finance Committee, rejecting prudent 75-25 split of POMV revenue

While the House Finance Committee agreed that significant PFDs are vital to many Alaskans, especially rural Alaskans, the Hannah Amendment failed by a 5-6 vote.

The amendment is in response to projections that continued 50-50 draws of the POMV of the Permanent Fund would diminish in a matter of years, placing Alaskans at risk of reduced services or new taxes. Ketchikan Representative Dan Ortez made bipartisan and multigenerational appeals when he stated “While yes, it’s important to the people now, in my district and to all of the people in all of our districts… it’s gonna be important to them in the future too.” “Both caucuses have spoken” he continued “about the need to be fiscally responsible, that that’s our priority is to be fiscally responsible. This amendment is a fiscally responsible amendment. It puts us on a path that’s sustainable. It puts us on a path to have potential PFDs in the future, for future generations.”

Rep. Galvin added that the responsible $1350 dividend for 2023 was strongly supported by her constituents who care about “having our public safety in check, our schools thriving not just surviving… and looking out for the future of our state and protecting our PFD.”

Now we await the legislature’s plan to overcome the budgetary shortfall today’s vote will lead to.

You can watch the deliberation and final vote here.

50-50 POMV split requires substantial new sources of revenue.

Referencing his seven years’ experience with fiscal modeling for the Legislature, Legislative Finance Division Director Alexei Painter reflects on the consistent findings that a 75-25 POMV split would allow for a balanced budget, whereas a 50-50 split opens the state up to an $800M budgetary shortfall which would require new sources of revenue.

Listen to Painter’s closing remarks at the 1:23:14 mark of the March 24 Senate Finance hearing.

‘A solution to Alaska’s PFD and budget struggle — less is more.’

Alaska resident and author Kate Troll advocates for the collective good of all Alaskans in her March 23 opinion in the Anchorage Daily News: “A solution to Alaska’s PFD and budget struggle — less is more.”

Senate Finance presentation on the state budget with fiscal scenarios highlights.

The March 24, 2023 Legislative Finance Division presentation discusses oil price volatility, highlights two fiscal models — one assuming the Department of Revenue’s forecast and another expressing the impact of revenue volatility — states the current balances of the Constitutional Budget Reserve and the Earnings Reserve Account and provides updated fiscal summaries and models.

Read the entire Fiscal Summary Update and Fiscal Scenarios presentation.

Senate Bill 107 establishes a new formula for the division of the annual Percent of Market Value draw from the Permanent Fund and the Permanent Fund dividend.

Sponsor’s Statement: Senate Bill 107 was introduced to continue the discussion about a long-term sustainable solution for the State of Alaska, and how the annual Percent of Market Value (POMV) from the Permanent Fund plays a role in our fiscal stability. SB 107 establishes a split for the annual POMV draw, with 75% remaining in the General Fund and 25% appropriated to pay Permanent Fund dividends.

The Permanent Fund was initially set aside for when oil would no longer be able to cover all the state’s budgetary needs. When Senate Bill 26 passed in 2018, establishing the POMV formula for using Permanent Fund earnings, the legislature accepted that this time had come. However, SB26 did not update the 1980s dividend formula. SB107 would replace that formula.

Not having a PFD formula creates uncertainty in the budgeting process. The POMV was passed in part to stabilize the state’s revenue. But if the dividend amount is unknown until late in session, the remaining POMV draw going to the General Fund is also unknown. Without knowing how much revenue is available, it is difficult to make budget decisions.

Also, a PFD based on a percentage of the POMV adds stability to both the budget and the dividend. The POMV is based on the overall value of the Permanent Fund, which is relatively stable and predictable. In contrast, the current statutory dividend formula is based on Permanent Fund earnings, which are much more volatile. If the general fund portion of the annual POMV payout is “whatever is left” after funding a volatile dividend, all that revenue volatility is transferred to the general fund – compounding fiscal uncertainty. Over the last six years this lack of consensus on the split of the POMV has put the legislature in a precarious position of formulating the state’s Operating and Capital budget without knowing what revenues were available to do so. Based on projections, a 75-25 split balances our budget into the future without needing new revenue sources and is the best starting point for a long term, sustainable state budget and dividend solution.

Rep. Zack Fields introduction of HB90, March 6, 2023 House Ways and Means Committee

House Bill 90 gives the legislature the authority to appropriate funds for a dividend, and it caps that amount at $1,000.

Sponsor Statement: HB 90 The purpose of this bill is to resolve the statutory conflicts regarding Permanent Fund Dividend payments and right-size PFD payments to protect access to annual dividend payments for future generations of Alaskans.

House Bill 90 gives the legislature the authority to appropriate funds for a dividend, and it caps that amount at $1,000.

Payment of PFDs based on a 1982 formula is no longer practical. Original legislative intent envisioned Permanent Fund Dividend payments of roughly $1,000, which is similar to the historic average of dividends over the last four decades. After a decade of public disinvestment that has led to declining schools, decaying infrastructure, and consistent out-migration,

Alaskans should recognize that supplementing incomes with super-sized PFDs cannot compensate for a failure to fund basic services. Fortunately, because of Alaska’s Permanent Fund endowment and resource wealth, the state can afford to fund adequate public services, and to pay a reasonable but not massive dividend.

Here’s how the math works: At current oil prices, we can fund all existing state services, reverse the last six years of cuts to education, pay a $1,000 PFD (the historic average, taking into account inflation), and that would leave us with an approximately $550 million surplus. We can reverse the trend of disinvestment, pay a PFD consistent with the historic average, and still have a budget surplus.

Once again, this year Alaska is in the enviable position of being able to fund public services with a combination of sustainable earnings from the Permanent Fund and revenue from oil production — even though individual Alaskans don’t pay a cent in state income or sales tax. Alaska is the only state in the U.S. to have such wealth, and it gives us the opportunity to plan and invest for the long term.

Watch the Rep. Zack Fields introduce HB90, March 6, 2023 here.

Representative Dan Ortiz introduction of HB72 House Ways and Means Committee, March 1, 2023

Permanent Fund Dividend; 75/25 POMV SPLIT

“An Act relating to use of income of the Alaska permanent fund; relating to the amount of the permanent fund dividend; relating to the duties of the commissioner of revenue; and providing for an effective date.”

Sponsor Statement

HB72 / 33-LS0413\B

Permanent Fund Dividend; 75/25 POMV Split

The purpose of this bill is to settle the age-old debate over which statutes to follow when it comes to

determining the size of a Permanent Fund Dividend (PFD). If adopted, it will reconcile the current

two competing statutes regarding the dividend amount.

House Bill 72, the Protecting Future Dividends Act (PFD Act), will put into statute the percent of

money from the POMV dedicated to a PFD. It establishes a 75/25 split in which 75 percent of the

Percent of Market Value (POMV) draw goes into the general fund and 25 percent of the POMV

draw goes to the dividend fund. It’s simple, and most importantly it’s sustainable.

The POMV draw is the largest single source of Unrestricted General Funds these days. Revenue

that the state receives from natural resource development no longer consistently makes up the

majority of our revenue. Instead, we rely on the POMV draw. As long as we continue to rely on the

POMV draw, this bill will continue to provide a PFD into the future.

Based on current projections, this bill allows us to balance our budget without needing to come up

with new revenue sources. Over the next ten years, if we pass and follow HB 72, and if resource

revenue remains stable and our state budget grows as anticipated, we won’t have a budget deficit

and we will have a PFD.

This bill does not make stipulations on how the money will be spent after the POMV draw is sifted

75/25 into the general fund and dividend fund. It simply provides structure as to where the POMV

is appropriated.

Watch the Rep. Zack Fields introduce HB90, March 6, 2023 here.

Legislative finance Division Fiscal Modeling chart.

July 11, 2022 Fiscal Update

“Below $87 oil, the FY23 budget has an unfilled deficit. The Legislature used the Statutory Budget Reserve (SBR) as the deficit-filling account. However, the Governor vetoed two transfers into that account in FY22 that together totaled nearly $1 billion. With those vetoes, those funds went to the Constitutional Budget Reserve (CBR) instead. This means that instead of having $1 billion to fill potential deficits, the SBR only has about $20 million. However, the legislature did not pass a 3/4 vote to use the CBR to fill deficits in FY23, so if oil prices drop, the State could face an unfilled deficit and need a CBR vote.”

Alexei Painter

Alexei Painter is the Legislative Fiscal Analyst with the Legislative Finance Division.

This year’s PFD is affordable, but it’s not sustainable

“This year’s Permanent Fund dividend, coupled with the energy assistance payment, are affordable this year because of high oil prices. But they are not sustainable once oil prices return to long-term averages. Or if inflation continues to run higher than normal. Or if the stock and bond markets have several years of losses resulting in substandard returns.”

Carl Marrs

Carl Marrs is the chief executive of Old Harbor Native Corp. and the chairman for Alaskans for Common Sense.

Thank you, legislators, for your fiscal responsibility

“Instead of beating up the Legislature for failure to adopt a new dividend formula to replace the 40-year-old one we can no longer afford, we should be thanking them for passing another balanced budget that provides a reasonable dividend without resorting to further cuts to public services or new taxes to pay for it.”

Carl Marrs

Carl Marrs is the chief executive of Old Harbor Native Corp.

OPINION: The Legislature shouldn’t cash out Alaska’s future

“….. But hopefully enough legislators have the common sense not to overdraw on Alaskans’ future by overspending on an excessive dividend formula, beyond a moderate energy relief check intended to help individuals cope with high fuel prices.”

Larry Persily

Larry Persily is a longtime Alaska journalist, with breaks for federal, state and municipal jobs in oil and gas and taxes, including deputy commissioner of the Alaska Department of Revenue 1999-2003.

Percent of Market Value (POMV) Spending Cap – A video from Rep. Matt Claman

As the budget moves forward, our office took a moment to put together an informational video about the percent of market value spending cap that is established in Alaska law. Watch the video to learn what it is and the importance of following this spending cap law.

From the office of Rep. Matt Claman